Draft 1 - Handed in for feedback

Dolce and Gabbana Brand Marketing Report

Executive Summary:

The purpose of this brand marketing report is to critically analyse the brand Dolce and Gabbana and see what issues are affecting the success of the brand. In order to create a strategic brand marketing report, we have used both primary and secondary research. We have ensured our report is relevant and informed by using our market research. This report is a comprehensive evaluation of the brands current market position and condition, including any external factors such as competitor analysis and political influences. We have produced a series of recommendations which are a result of our analysis of the brand and consist of what we think will make the brand as successful as it once was.

Methodologies we used included marketing frameworks such as marketing mix, PESTLE and SWOT analysis. We have explored the complex needs and wants of the consumer by using surveys and visiting stores. The main findings we have concluded from our research include the lack of sensitivity over social media. This has caused outrage with consumers and leading to numerous people and celebrities boycotting the brand, resulting in loss of sales.

Reasons the brand is trailing behind their competitors such as Gucci include an out of date perspective when handling ethical issues such as the welfare of animals and a lack of consideration for sustainability. This leads to consumers buying from competitors and putting Dolce and Gabbana at a disadvantage. We also discovered that Dolce and Gabbana are targeting such a wide range of consumers that their products and styles are getting mixed up, we feel as though the more focus on the millennial demographic leads to loss of the more traditional demographic and leading to her going to shop at a different brand where she feels more wanted.

Recommendations we have concluded from this report include the re-launch of D&G; the brands original diffusion brand, with a new sustainable and ethical perspective. Dolce and Gabbana’s main line will then go back to focussing on the traditional consumer by starting with an Italian heritage collection.

Introduction:

We have been asked to critically explore the brand Dolce and Gabbana, their products, consumers and how they operate within the wider market place. We plan to discover what issues are causing Dolce and Gabbana to lose sales and dilute their brand image. We will research into the numerous issues the brand faces and provide our recommendations which we believe will make the brand as successful as it once was.

Dolce and Gabbana was founded in 1985 by Italian design duo; Domenico Dolce (1958, Sicily) and Stefano Gabbana (1962, Milan) (Craven, 2008) . The pair pride themselves on their distinctive style of Italian heritage and culture which is represented by their creative and stylish designs.

The total turnover of Dolce and Gabbana was 991 million euros, this was a decrease from 2016 where it amounted 998.46 million euros and only 119.57 million more than the total revenue in 2012 (Statista, 2019) . In this report we will investigate as to why Dolce and Gabbana’s market position has decreased and lead to loss of sales.

Macro-Economic analysis (PESTLE):

If the Brexit vote goes forward it will affect Dolce and Gabbana with imports and exports to Britain and new trade agreements will have to be made (Hendriksz, 2016) . It may also affect relationships to Britain and methods of production (Wang, 2017) .

The devaluation of the pound due to Brexit will mean that the pound is the weaker currency compared to the euro, this means that to ensure Dolce and Gabbana don’t lose out on money they have to charge more in the UK for their products. This could potentially make the brand lose out on sales in Britain as consumers will wait until they are next in Europe to purchase at a cheaper price (Hendriksz, 2016) . As a business, Dolce and Gabbana will be affected by economic fluctuations, meaning when the market conditions are better people have more disposable income, therefore Dolce and Gabbana will have an increase in sales. However, a recession will have the opposite effect and lead to less sales (Suttle, n.d.) .

Consumer attitudes have evolved over the past few years towards buying from brands who are not fully sustainable and still test on animals (Neimtzow, 2017) . In the next few years we predict consumers will boycott Dolce and Gabbana if they do not change their unethical habits.

In 2012 Dolce and Gabbana released an App for smartphones (Parker, 2012) . However, this was unsuccessful, and the app is no longer available. Due to the failure or the app Dolce and Gabbana could potentially be losing out on sales especially from the millennial consumer; as there is less connection with customers and product is not as readily available (Blair, n.d.) .

Dolce and Gabbana were wrongly accused of tax evasion, this was damaging to the brand and took the attention away from the designs of the brand (BBC, 2014) . It is a legal requirement of Dolce and Gabbana to ensure they are paying correct taxes as to avoid such cases as this. Another legal requirement includes making sure all labels include necessary information such as fabric content, safety information and washing instructions (GOV, 2016) .

Dolce and Gabbana state in their code of ethics that they respect the environment and they have adopted a sustainable conduct when performing activities and supporting projects to combat climate change; however there is no proof of this statement to be true and when asked about what efforts they make to protect the environment, Dolce and Gabbana fail to comment (Dolce and Gabbana, n.d.) .

Brand market position SWOT:

A strength of Dolce and Gabbana is the luxurious brand image which has been established through its extensive history; it is stylish, sophisticated and sought after in the fashion world (Reinach, 2018) . This status has been aided by the help of celebrity support which promotes the brand and increases desirability to consumers (Elle, 2015) .

Controversies have plagued the brand image of Dolce and Gabbana from an ethical stand point; the most recent being the racism scandal in Shanghai. This is a weakness. Another recent controversy which has weakened the brand, includes when the design duo expressed their homophobic outlook and referred to IVF children as ‘synthetic’ (Ferrier, 2015) .

Opportunity for Dolce and Gabbana occurs in the form of a collaboration with another brand such as Supreme and Louis Vuitton (Woolf, 2017) . Louis Vuitton also lead a great example in hiring Vigil Abloh as artistic director, Dolce and Gabbana could gain inspiration from this and hire a new creative director who could give the brand an up to date perspective (Abad, 2018) .

The potential loss of the Chinese market after the recent Shanghai scandal could be threatening for Dolce and Gabbana (BBC, 2018) . Experts think Dolce and Gabbana could lose up to 20% of the current brand value of $937 million (NBC, 2018) .

The increasing number of counterfeits is a problem for the luxury brand; consumers will buy cheaper imitations of Dolce and Gabbana products; this lessens the exclusivity of the brand (Baker, 2017) .

Increased competition is also a potential threat, brands will all compete in terms of innovation and style as well as keeping up to date with consumer needs and technological factors.

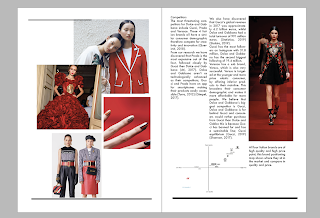

Competitors:

The most threatening competitors for Dolce and Gabbana include Gucci, Prada and Versace. These 4 Italian brands all have a similar consumer demographic therefore compete for creativity and innovation (Querimit, 2018) .

From our research we have discovered that Prada is the most expensive out of the four, followed closely by Gucci then Dolce and Gabbana (Ati, 2017) . Dolce and Gabbana aren’t as technologically advanced as their competitors; Gucci and Prada have an app for smartphones making their products easily accessible (Turra, 2012) (Gimpel, 2017) .

We also have discovered that Gucci’s global revenue in 2017 was approximately 6.2 billion euros, whilst Dolce and Gabbana had a total turnover of 991 million euros. (Statistica, 2019) (Statista, 2019) .

Gucci has the most followers on Instagram with 31.8 million, Dolce and Gabbana has the second biggest following of 19.4 million.

Versace has a sub brand, Versus, which is also very successful. Versus is targeted at the younger and more price elastic consumer, by offering inferior products to their mainline. This broadens their consumer demographic and makes it more affordable for more people. We believe that Dolce and Gabbana’s biggest competitor is Gucci, Dolce and Gabbana is far behind Gucci and consumers would rather purchase from Gucci than Dolce and Gabba this is because Gucci has banned fur and has a sustainable line; Gucci equilibrium (Gucci, 2019) (Shannon, 2017) .

All four Italian brands are of high quality and high price point, this brand positioning map shows where they sit in the market and compare in quality and price.

Consumer Demographic:

The typical consumer demographic for Dolce and Gabbana is a middle aged woman aged 25+ , she is very fashion conscious and has a high income. Due to its status as a designer brand in more recent years Dolce and Gabbana has extended its appeal and consumer demographic to a younger millennial demographic; due to exposure by means of influencer marketing. Although the millennial product is more colourful and steers away from the traditional Italian roots the collections are still of a very high price and the consumer must have a high income.

Dolce and Gabbana has such a wide range of products and appeals to a wide range of demographics.

DNA 2018 catwalk showed three generations of the same family walk down the catwalk together all in Dolce and Gabbana (Valenti, 2018) . This suggests that Dolce and Gabbana targets families and mothers. The children’s line is aimed for mothers, this means the women is most likely aged 25 and above. Isabella Rossellini (age 66) lead her daughter Elettra Wiedemann (age 35) down the catwalk in 2018 showing the ideal D&G Family (Michallon, 2018) . This is Dolce and Gabbana showing women of this age category that their designs are aimed for them. Therefore, I believe that the consumer demographic for Dolce and Gabbana is women aged 25-65.

However, on the reverse side of this the brand has a campaign called #DGinfluencers. In their Fall 2017 show in Milan the brand got a selection of millennials and influencers involved with their brand by walking down the catwalk instead of models (Ogunnaike, 2017) . This was a clear effort to connect with the social media age and millennials. Youtubers such as Cameron Dallas and Jim Champman. The people who walked in this runway may not even be recognised by people aged 30 and over (Okwodu, 2017) . Not only does this catwalk connect with a younger demographic but by using influencers they admire.

Dolce and Gabbana tend to target their millennial demographic over social media and online, however this separates the older demographic and having all the focus on the younger consumers may leave them feeling isolated and they will turn to a competitor brand where they feel valued.

Product Selection:

Dolce and Gabbana sells a wide range of luxury goods suited for different consumer needs. Their products include; Men’s, Women’s and children’s apparel, footwear, handbags, accessories, sunglasses, watches, Jewellery, perfumes, makeup and watches (Dolce and Gabbana, n.d.) .

Dolce and Gabbana differentiates itself from other brands with its bright and bold prints and designs which are inspired by the culture of Italy (Dolce and Gabbana, n.d.) .

The price is very high for Dolce and Gabbana and is targeted at consumers with a high income.

Dolce and Gabbana used to have two main lines until 2012: Dolce and Gabbana and D&G. Dolce and Gabbana specialised in more luxury items that had a formal style, inspired by the existing trends and seasonal changes. D&G however was targeted at a younger demographic and sold clothing and watches. D&G designs were flamboyant and creative and had more of an urban street style inspiration. D&G was stopped in 2012 so that the brand could focus only on their main line (Alexander, 2011) .

Social Media and influencer marketing:

Dolce and Gabbana targets millennials through social media and influencer marketing.

The fall 2017 collection in Milan featured 49 influencers walking the catwalk including Jim Chapman, Cindy Crawford’s son Presley Gerber and Tinie Tempah (Ogunnaike, 2017)

Stefano Gabbana said, “These are the new generation, we liked the idea of adding ordinary people who have become famous thanks to the web” (Hello Magazine, 2017) . This catwalk was definitely inspiring for the brands younger millennial consumers however their older and traditional consumer most likely won’t even know who these people are meaning It will not have the same appeal to the older demographic (Okwodu, 2017) . Millennials who see the influencers wearing Dolce and Gabbana will feel inspired and buy the clothes for themselves, this is influencer marketing.

Influencer marketing is a relationship between a brand and an influencer, in this case Dolce and Gabbana and all 49 influencers; The influencer will post about the brand over social media such as Instagram and YouTube to connect with a specific audience (Matthew, 2018) .

Dolce and Gabbana’s social media accounts are relatively active however they are not as active as competitor Gucci’s social media pages. We conducted a social media review where we compared the different Dolce and Gabbana social media platforms to see which one was used the most and interacted with by consumers. After this seven-day review, we concluded that the most popular social media platform was Instagram; here they uploaded an average of three times a day and had over 19.2 Million followers. The number of followers also increased by 100000 over the week. The YouTube account was hardly used and wouldn’t be the most effective method of connecting with the consumer. The twitter was active and posted the same posts from Instagram however they only had 5.26 thousand followers.

From this research we can see that if the brand wants to use social media to promote product then we can see that the best way to achieve that would be over Instagram. Our research also shows us that 68% of Instagram users are under the age of 35; this means that the older consumer demographic is unlikely to see this marketing, this could lead to loss of consumer and leave the older demographic feeling isolated and unwanted therefore they will go and shop at competitor brands (Statista, 2018) .

Marketing mix

As a leading fashion brand Dolce and Gabbana has a wide range of products suited for a number of different consumers including apparel for women, men and children; along with footwear, handbags, sunglasses, watches, jewellery, perfumes, makeup and watches (Dolce and Gabbana, n.d.) . Dolce and Gabbana’s product is different to its competitors as it has a wide range of creative styles all going back to the traditional Italian roots that Dolce and Gabbana strives to be inspired by.

As a high-end luxury brand Dolce and Gabbana products are priced high and they appeal to a consumer demographic of individuals belonging to the elite and high class.

Dolce and Gabbana headquarters are situated in Milan and they have stores all over the globe including New York, Tokyo and Hong Kong (Dolce and Gabbana, n.d.) (Arch Daily, 2008) . Dolce and Gabbana also have tie-ups on various e-commerce platforms where they offer selected products, however to maintain their brand status of being an exclusive brand catering to the ultra-rich segment of consumers they have controlled the number of their distribution outlets to a few as these are not products that would be preferred by a mass audience. The brand also did a one-off collaboration with Harrods in London in December 2017 (Indvik, 2017) .

Dolce and Gabbana use different methods to promote their brand, they use television, websites and social media. They are often featured in magazines such as Vogue all over the world. Celebrity endorsement is also a good promotional tactic for Dolce and Gabbana using celebrities such as Madonna(Ilari, 2009) . Another promotional tactic for the brand is when rappers use their brand in their songs such as Nicki Minaj, ASAP Rocky and Kanye West. Although the brand does not ask these artists to put them in their music it is a very good promotional technique which exposes the brand and they are being recognised for being reputable not because they are paying them too.

Dolce and Gabbana are known for having controversial advertisement such as the recent Shanghai Scandal where they featured a Chinese model eating Italian food with chopsticks, they also are known for objectifying women and showing them in a degrading manner (Suen, 2018) . Dolce and Gabbana have been in the news and press for a lot of negative and controversial advertisements (Duncan, 2015) .

Some may argue that the Controversies that surround the brand constantly such as the cyber bullying, the Hong Kong photo ban, racist campaigns and dressing the first lady Melania Trump could be a tactic for the brand to receive more attention and promote their brand to the public. Although these controversies are negative and surround the brand with many negative connotations it allows more people to know of the brand.

Bibliography

(n.d.). Retrieved from Dolce and Gabbana: http://www.dolcegabbana.com/corporate/en/group/code-of-ethics.html

(n.d.). Retrieved from Dolce and Gabbana: http://www.dolcegabbana.com

(2016). Retrieved from GOV: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/513963/BIS-16-193-textile-labelling-regulations-guidance.pdf

(2018). Retrieved from NBC: https://www.nbcnews.com/news/asian-america/dolce-gabbana-fiasco-shows-importance-risks-china-market-n940706

(2019). Retrieved from Gucci: http://equilibrium.gucci.com/environment/

Abad. (2018). Retrieved from Forbes: https://www.forbes.com/sites/marioabad/2018/03/26/louis-vuitton-appoints-virgil-abloh-as-its-new-mens-artistic-director/

Alexander. (2011). Retrieved from Vogue: https://www.vogue.co.uk/article/dolce-and-gabbana-considers-merging-dandg-line

Arch Daily. (2008). Retrieved from https://www.archdaily.com/2458/dolce-gabbana-headquarters-studio-piuarch

Ati. (2017). Retrieved from https://www.stylecraze.com/articles/most-expensive-clothing-brands/#gref

Baker. (2017). Data Dot. Retrieved from https://www.datadotdna.com/how-counterfeiting-can-destroy-your-brand-business/

BBC. (2014). BBC. Retrieved from https://www.bbc.co.uk/news/business-29764828

BBC. (2018). Retrieved from https://www.bbc.co.uk/news/entertainment-arts-46288884

Blair. (n.d.). Build Fire. Retrieved from https://buildfire.com/ways-business-benefit-having-mobile-app/

Craven. (2008). Vogue. Retrieved from https://www.vogue.co.uk/article/dolce-and-gabbana-biography

Dolce and Gabbana. (n.d.). Retrieved from http://www.dolcegabbana.com/discover/dolce-and-gabbana-inspiration-of-classic-dna-looks-for-men-and-women/

Dolce and Gabbana. (n.d.). Retrieved from http://www.dolcegabbana.com/store-locator/united-kingdom/

Duncan. (2015). Metro. Retrieved from https://metro.co.uk/2015/03/18/dolce-gabbana-in-hot-water-again-after-gang-rape-ad-campaign-resurfaces-just-days-after-ivf-furore-5108624/

Elle. (2015). Retrieved from https://www.elle.com/uk/fashion/trends/articles/g11120/stars-wearing-dolce-and-gabbana/

Elle. (2015). Retrieved from https://www.elle.com/uk/fashion/trends/articles/g11120/stars-wearing-dolce-and-gabbana/

Ferrier. (2015). The Guardian. Retrieved from https://www.elle.com/uk/fashion/trends/articles/g11120/stars-wearing-dolce-and-gabbana/

Gimpel. (2017). Marie Claire. Retrieved from http://www.marieclaire.co.za/fashion/going-places-gucci

Hello Magazine. (2017). Retrieved from https://www.hellomagazine.com/fashion/news/2017011656715/dolce-gabbana-influencer-show-pre-fall-2017/

Hendriksz. (2016).Fashion United. Retrieved from https://fashionunited.uk/news/fashion/6-effects-a-brexit-may-have-on-the-fashion-industry/2016062020813

Ilari. (2009). WWD. Retrieved from https://www.vogue.co.uk/gallery/dolce-gabbana-italian-christmas-market-london-harrods-exclusive

Indvik. (2017). Vogue. Retrieved from https://www.vogue.co.uk/gallery/dolce-gabbana-italian-christmas-market-london-harrods-exclusive

Matthew. (2018). Forbes. Retrieved from https://www.forbes.com/sites/theyec/2018/07/30/understanding-influencer-marketing-and-why-it-is-so-effective/#683a27271a94

Michallon. (2018).Daily Mail. Retrieved from https://www.dailymail.co.uk/femail/article-5719551/Isabella-Rosselliniposes-daughter-Elettra-Wiedemann-new-jewelry-campaign.html

Neimtzow. (2017). BSR. Retrieved from https://www.bsr.org/en/our-insights/blog-view/luxury-sustainability-desirability-two-new-rules-of-the-game

Ogunnaike. (2017).Elle. Retrieved from https://www.elle.com/fashion/news/a43345/dolce-gabbana-fall-show-2017-blogger-models/

Okwodu. (2017). Vogue. Retrieved from https://www.vogue.com/article/dolce-gabbana-spring-2018-models-over-millennials

Parker. (2012). Android Authority . Retrieved from https://www.androidauthority.com/dolce-gabbana-d-g-app-review-97475/

Querimit. (2018). Humble and Rich. Retrieved from https://boutique.humbleandrich.com/italian-fashion-designer-brands/

Reinach. (2018). Love To Know. Retrieved from https://fashion-history.lovetoknow.com/fashion-clothing-industry/fashion-designers/dolce-gabbana-brand-history

Shannon. (2017). Business of Fashion. Retrieved from https://www.businessoffashion.com/articles/news-analysis/gucci-bans-fur-saying-its-not-modern

Statista. (2018). Retrieved from https://www.statista.com/statistics/325587/instagram-global-age-group/

Statista. (2019). Retrieved from https://www.statista.com/statistics/675280/turnover-of-italian-company-dolce-and-gabbana/

Statistica. (2019). Retrieved from https://www.statista.com/statistics/267733/global-revenue-share-of-gucci-by-region/

Suen, H. a. (2018). Business Of Fashion. Retrieved from https://www.businessoffashion.com/articles/news-analysis/assessing-the-damage-after-the-dolce-gabbana-uproar-racism-china

Suttle. (n.d.). Retrieved from https://smallbusiness.chron.com/macroenvironmental-factors-affecting-clothing-industry-37254.html

Turra. (2012). WWD. Retrieved from https://wwd.com/fashion-news/fashion-scoops/joining-the-app-race-6471127/

Valenti. (2018). Vogue. Retrieved from https://www.vogue.com/article/dolce-gabbana-isabella-rossellini-elettra-wiedemann-spring-2019-milan-fashion-week

Wang. (2017). International Excellence. Retrieved from Wang. (2017). International Excellence. Retrieved 27 January, 2019, from https://internationalexcellence.co.uk/content/how-will-brexit-affect-luxury-brands

Woolf. (2017). CQ. Retrieved from https://www.gq.com/story/supreme-louis-vuitton-collaboration-2017

Comments

Post a Comment