Final Draft - Writing

Dolce and Gabbana Brand Marketing Report

Executive Summary:

The purpose of this brand marketing report is to critically analyse Dolce and Gabbana and see what issues are affecting their success. In order to create the report, the researcher provides information from both primary and secondary sources.

The researcher has produced a series of recommendations based on their analysis of the brand. These recommendations are directed towards re-building the success of the brand to re-position it, so it can become more successful in the luxury fashion market. Methodologies used include marketing frameworks such as marketing mix, PESTLE and SWOT analysis.

The main findings concluded from this research are as follows: the lack of sensitivity over social media, this has caused outrage with consumers and led to numerous people and celebrities boycotting the brand; resulting in loss of sales. Ethical issues, the brand is trailing behind their competitors such as Gucci because they have an out of date perspective when handling ethical issues such as the welfare of animals and a lack of consideration for sustainability. This leads to consumers buying from competitors and putting Dolce and Gabbana at a disadvantage. Customer profile, it was also discovered that Dolce and Gabbana are targeting such a wide range of consumers, that their products and styles are getting mixed up.

Recommendations concluded from this report include splitting the brand into two separate lines. The re-launch of D&G; the brands original diffusion brand, with a new sustainable and ethical perspective to target a millennial/ Gen Z demographic.

To re-launch D&G the researcher suggests that Dolce and Gabbana target this demographic by doing a streetwear collaboration. Dolce and Gabbana’s main original line will then go back to focussing on the core consumer (age 30-50) by focussing on the strengths of the brand by starting with an Italian heritage collection. This will lead to each demographic having a collection suited to them and will ensure each group of consumer feels valued.

Introduction:

The aim of this report is to critically explore Dolce and Gabbana; their products, consumers and how they operate within the wider market place. This will highlight what issues are causing Dolce and Gabbana to lose sales and dilute their brand image. The researcher will analyse the numerous issues the brand faces and provide their recommendations which they believe will make the brand as successful as it once was. Dolce and Gabbana was founded in 1985 by Italian design duo; Domenico Dolce and Stefano Gabbana(Leitch and Evans, 2017).

The pair pride themselves on their distinctive style of Italian heritage and culture which is represented by their creative designs and Mediterranean aesthetic; they have been able to maintain this strong identity of Dolce and Gabbana by evolving over the years but never forgetting their roots (Reinach, 2018) . Dolce and Gabbana’s debut came in 1985 at Milan Fashion Week and have been going strong ever since (Business of fashion, n.d.) .

Information from this graph comes from Statista (Statista, 2019) . The graph shows the turnover of Dolce and Gabbana between 2011 and 2017 (in million euros).

The total turnover of Dolce and Gabbana was 991 million euros, this was a decrease from 2016 where it amounted 998.46 million euros and only 119.57 million more than the total revenue in 2012 (Statista, 2019) . This report will investigate why Dolce and Gabbana’s market position has decreased and lead to loss of sales.

Macro-Economic analysis (PESTLE):

If the Brexit vote goes forward it will affect Dolce and Gabbana as new trade agreements will have to be made with Britain (Hendriksz, Fashion United, 2016) . It may also affect relationships to Britain and methods of production as well as high import duties with direct impact on selling prices (Wang, 2017) .

The devaluation of the pound due to Brexit will mean that the pound is the weaker currency compared to the euro, this will increase the price of Dolce and Gabbana products in the UK (Webb, 2018) . A concern is that consumers could wait until they are next in Europe to purchase at a cheaper price (Hendriksz, Fashion United, 2016) . The brand will be affected by economic fluctuations; when market conditions are better there is more disposable income for consumers to spend on luxury goods, leading to an increase in sales. However, a recession will have the opposite effect (Suttle, n.d.) .

Consumer attitudes have recently evolved, they are beginning to avoid brands who are unethical and unsustainable (McNeil and Moore, 2015)

Dolce and Gabbana released an APP in 2012 which was unsuccessful (Parker, 2012) . Due to the failure of the APP the brand could be losing out on sales, particularly the younger demographic as product is not as available (Blair, n.d.) .

The brand was wrongly accused of tax evasion; this caused a lot of negative publicity and diverted attention away from the products (BBC, 2014) . It is a legal requirement to ensure they are paying the correct taxes to avoid future issues. Another legal requirement includes making sure all labels include necessary information such as fabric content, safety information and washing instructions (GOV, 2016) .

In the code of ethics, the brand state that they respect the environment, have a sustainable conduct and support projects to combat climate (Dolce and Gabbana, n.d.) ; there is no evidence to support these statements and Dolce and Gabbana fail to comment on these efforts when asked (Rank A Brand, 2018) .

Brand market position SWOT:

Strengths of Dolce and Gabbana include the luxurious brand image which has been established through the brands extensive history; it is stylish and sought after (Reinach, 2018) . This status has been aided by the help of celebrity support which increases desirability to consumers (Elle, 2015) .

Controversies have plagued the brand image of Dolce and Gabbana from an ethical stand point; the most recent being the racism scandal in Shanghai (Hall & Suen, 2018) . In which they had to cancel their show in Shanghai after a racist marketing campaign; advertising a Chinese model eating classical Italian food with chopsticks (BBC , 2018) . Another recent controversy which has weakened the brand, was when the design duo expressed their homophobic outlook and referred to IVF children as ‘synthetic’ (Ferrier, 2015) .

Opportunity for the brand includes an expansion of consumers via a streetwear collaboration similar to the Supreme and Louis Vuitton collection (Woolf, 2017) . Along with this they could hire a new artistic director to give an up to date perspective on the brand such as Louis Vuitton hiring Virgil Abloh (Abad, 2018) .

The potential loss of the Chinese market after the recent Shanghai scandal could be threatening for Dolce and Gabbana (BBC, 2018) . Experts think Dolce and Gabbana could lose up to 20% of the current brand value of $937 million (NBC, 2018) .

The increasing number of counterfeits is a problem for the luxury brand; consumers will buy cheaper imitations of Dolce and Gabbana products; this lessens the exclusivity of the brand (Baker, 2017) .

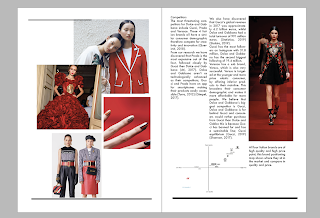

Competitors:

Competitors for Dolce and Gabbana include Gucci, Prada and Versace. All 4 Italian brands have a similar consumer demographic therefore compete for creativity and innovation (Querimit, 2018) .

Research shows Prada is the most expensive, followed closely by Gucci then Dolce and Gabbana (Ati, 2017) . Dolce and Gabbana are not as technologically advanced as their competitors; Gucci and Prada have an app for smartphones making their products easily accessible(Turra, 2012) (Gimpel, 2017) .

The researcher discovered that Gucci’s global revenue in 2017 was approximately 6.2 billion euros, whilst Dolce and Gabbana had a total turnover of 991 million euros.(Statista, 2019) (Statista, 2019) .

Gucci has the most followers on Instagram with 31.8 million, Dolce and Gabbana has the second biggest following of 19.4 million (Liakou, 2017) .

Versus is a successful diffusion brand of Versace which offers inferior products to their mainline. This expands Versace’s demographic into a younger more price elastic consumer (Ryan, 2017) Gucci has a similar diffusion line which focuses on sustainability and is really successful with millennial and Gen Z consumers (Gucci, 2019) (Shannon, 2017) .

All four Italian brands are of high quality and high price point, this brand positioning map shows where they sit in the market and compare in quality and price.

Consumer Demographic:

The typical consumer for Dolce and Gabbana is women aged 30-50, they are fashion conscious and have a high income. In more recent years Dolce and Gabbana has extended its appeal to a younger millennial demographic; due to exposure by means of influencer marketing (Yiassoumi, 2017) .The products aimed at the younger demographic are bold and flamboyant and contrasts to old classic collections.

DNA 2018 catwalk demonstrated the ideal Dolce and Gabbana family(Valenti, 2018) . Isabella Rossellini (age 66) lead her daughter Elettra Wiedemann (age 35) down the catwalk as well as her granddaughter (Michallon, 2018) . This demonstrates Dolce and Gabbana can be worn by multiple age ranges. The children’s wear line is aimed at mothers, this shows the women is most likely aged 25 and above (LaManga, 2018) .

In contrast to this, the Spring/Summer 2018 menswear show was aimed heavily at millennials. The focus was on the younger demographic via the designs, millennial models and the celebrity millennial audience such as Christian Combs and Amelia Hamlin (GQ Magazine, 2017) . Whilst representing the brands original theme they adapted it to have increased colours and creativity. By using just millennials for this show it shows us how the brand is looking to appeal to people of a similar age range (DeAcetis, 2018) .

The researcher thinks that this focus on a younger demographic could potentially leave the traditional demographic feeling confused, unwanted and isolated as there is not much attention for them.

Product Selection:

Dolce and Gabbana sells a wide range of luxury goods suitable for various consumer needs. Their products include; Men’s, Women’s and children’s apparel, footwear, handbags, accessories, sunglasses, watches, Jewellery, perfumes, makeup and watches (Dolce and Gabbana, n.d.) .

Dolce and Gabbana differentiates itself from other brands with its bright, bold prints and designs which are inspired by the culture of Italy (Helms, 2018) .

The high retail selling prices target a wealthy consumer who is after more exclusive products (Daily Mail, 2013) .

Up until 2012 Dolce and Gabbana had two main lines: Dolce and Gabbana and D&G. Dolce and Gabbana specialised in more luxury items that had a formal style, inspired by the existing trends and seasonal changes. D&G however was targeted at a younger demographic and sold clothing and watches. D&G designs were flamboyant and creative and had more of an urban street style inspiration. D&G was stopped in 2012 so that the brand could focus only on their main line (Alexander, 2011) .

Social Media and influencer marketing:

The research shows how Dolce and Gabbana targets a younger demographic via social media and influencer marketing. The recent campaign ‘#DGInfluencers’ lead us to see social media influencers and celebrity offspring walk the catwalk for the menswear Fall 2017 collection (Ogunnaike, 2017) . The influencers who walked in this runway, including Jim Chapman and Cameron Dallas, may not even be recognised by people aged 30 and over (Okwodu, 2017) . This collection connects with a younger millennial and Gen-Z consumer.

“These are the new generation, we liked the idea of adding ordinary people who have become famous thanks for the web” (Stefano Gabbana, 2017).

Millennials who see the influencers wearing Dolce and Gabbana will feel inspired and buy the clothes for themselves, this is influencer marketing and it is not as effective for an older audience, as the influencers are not idols of the older demographic. Influencer marketing could be possible for an older consumer, but the right influencers must be used (Wiley, 2018) .

Influencer marketing is a relationship between a brand and an influencer, in this case Dolce and Gabbana and all 49 influencers; The influencer will post about the brand over social media such as Instagram and YouTube to connect with a specific audience (Matthew, 2018) .

By conducting a 7-day social media review, the researcher discovered that Dolce and Gabbana’s most active social media platform is Instagram; here they post on average 3 times a day and had over 19.2 Million followers. The number of followers increased by 100,000 followers over the week (see appendix A).

The YouTube account was inactive and would not be the most effective way of communicating to consumers as it had the least number of followers, therefore the least interaction. The brands Twitter account was active and had the same content as Instagram, however they only had 5.26 thousand followers.

The researcher has concluded that the most adequate way to reach consumers would be via Instagram.

The researcher also identified that 68% of Instagram users are under the age of 35; this suggests that the older demographic is unlikely to see this marketing via social media(Statista, 2018) . The lack of exposure to the older demographic could lead to loss of sales and feeling neglected by the brand.

Marketing mix

As a leading luxury fashion brand Dolce and Gabbana offers a wide range of products suited for a number of different consumers.

Dolce and Gabbana’s product is different to its competitors as it has a wide range of creative styles all going back to the traditional Italian roots that Dolce and Gabbana strives to be inspired by (Yotka, 2016) .

As a high-end brand selling luxurious products Dolce and Gabbana products are priced high, and they appeal to a consumer demographic of individuals belonging to the elite and high class. As a designer brand people wear as a symbol, Dolce and Gabbana is sought after, and they can command a premium pricing strategy (Briggs, 2017) .

Dolce and Gabbana headquarters are situated in Milan and they have stores all over the globe including New York, Tokyo and Hong Kong (Dolce and Gabbana, n.d.) (Arch Daily, 2008) . Dolce and Gabbana also have tie-ups on various e-commerce platforms where they offer selected products. In order to maintain being an exclusive brand they have lowered the number of their distribution outlets to a few as these are not products that would be consumed by a larger audience. The brand also did a one-off collaboration with Harrods in London in December 2017, which was a massive success (Indvik, 2017) .

To promote their brand Dolce and Gabbana use television, websites and social media. They are often featured in magazines such as Vogue (Fashion Lover, 2011) .

Celebrity endorsement is also a good promotional tactic for Dolce and Gabbana using celebrities such as Madonna (Ilari, 2009) .

Rappers such as ASAP Rocky and Kanye West have used the brand name in songs (Genius, 2012) , this is a good promotional tactic as it increases exposure to the brand and they are being recognised for being reputable not because they are paying them too (Holody & Flynn, 2017) .

Dolce and Gabbana have been in the spotlight for negative and controversial issues numerous times over the years (Duncan, 2015) .

It is argued that these controversies such as; cyber bullying and degrading women, may increase exposure to the brand. This projects the brand with negative connotations however it does promote the name to consumers who may not have heard of it before (Sherman, 2018) .

Recommendations: (800 words)

From critically analysing the brand Dolce and Gabbana, the researcher has come up with the following recommendations which they believe will improve the brands brand image and increase sales and popularity.

The researcher believes the damaging perceptions of the designer will not change; however, to become successful again they must focus on averting the consumers attention from ethical issues and highlight the reasons why Dolce and Gabbana are one of the most recognised brands in the world.

The first recommendation is to split Dolce and Gabbana back into their original two brands; D&G the diffusion brand and Dolce and Gabbana the main line.

The research suggests the brands consumer demographic is very broad and they are trying to target too many demographics at once. By splitting the brands there will be a clear consumer demographic for each brand meaning consumers don’t feel neglected and all collections will be appropriate to each demographic.

D&G:

D&G will be the diffusion line focussing on the Gen-z/ millennial consumers aged 17-30. This brand will have flamboyant and colourful designs following current streetwear trends as well as setting their own trends with bold and innovative ideas.

This line will have a lower price point than Dolce and Gabbana because the consumer demographic will be of a lower income.

APP:

The researcher recommends D&G releases an APP in order to keep consumers up to date with current products and information.

Relationships between consumer and brands will be strengthened via the APP, it allows consumers to be constantly updated with the brand.

Products will be available to purchase on the APP to increase sales; younger consumers are more likely to purchase online than in store. The researcher conducted a survey in which they discovered that 56% of consumers aged 16-25 prefer to shop online (see appendix B).

There should be push notifications available, consumers will get regular reminders about the brand, the brands name will be seen by the consumer frequently meaning it becomes familiar and constantly reminding them about D&G.

Sustainable outlook:

Sustainability is a vital concept in today’s fashion landscape. The Millennial/ Gen Z consumer is passionate about buying from brands who are sustainable as evidenced in the survey conducted by the researcher; 44% of consumers in this demographic consider sustainability when purchasing from a luxury brand, in another question the researcher identified 34% of them will not purchase if they are aware that the brand is unsustainable (see appendix C).

In a study conducted by Mintel Academic in October 2017 they found that 70% of 16-24’s believe that fashion retailers should be more environmentally friendly (Apsit-Livens, 2018) . Dolce and Gabbana currently achieve an E-Label in sustainability which is the lowest rate possible (Rank A Brand, 2018) .

D&G will have a sustainable outlook and publicly announce their efforts to protect the environment to keep consumers informed. By doing this the brand is meeting the standards of competitors such as Gucci’s sustainable diffusion line; Gucci Equilibrium (Econyl, 2018) .

Influencer Marketing:

The researcher recommends that D&G continues to use influencer marketing as they have been, for example the Fall 2017 show as researched earlier in the report. The Gen-Z consumer are most likely to see the brand over social media and through the use of influencer marketing (Kim and Ko 2012).

It is crucial to pick the correct influencers to use, this influencer needs an audience of consumers with high income.

Cruelty Free:

D&G will also be cruelty free, this will be good for the brand image and demolish any negative connotations connected with previous unethical habits of Dolce and Gabbana, such as torturing Orylag rabbits (Robbins, 2017) .

It is important that this is communicated to consumers, so they know that the brands ethics have changed.

In the same survey the researcher discovered that if a luxury brand was not cruelty free: 40% of consumers would not purchase from the brand (see appendix D).

In the study conducted by Mintel Academic they discovered that 37% of UK consumers say that animal welfare is important to them (Apsit-Livens, 2018) .

Streetwear Collaboration:

D&G will have innovative designs targeted at a younger audience, these designs will be bright and follow streetwear trends, they will also offer customer clothing and trainers so consumers can have original and one-off pieces.

The brand will focus on apparel for men and women as well accessories and footwear.

To launch the brand the researcher suggests that they collaborate with a streetwear brand to increase desirability.

Brands who have already set this example for D&G to follow include; Louis Vuitton X Supreme and Versace X Kith.

The brand could collaborate with an Italian streetwear brand so as to keep the traditional Italian style; they could break these boundaries and collaborate with other brands who are not Italian such as Cottweiler, A-COLD-WALL or Helmut Lang.

The luxury fashion industry has been merging with the streetwear scene not only to tap into a younger demographic but to experiment with different trends and styles. By expanding into the streetwear market luxury brands can stay relevant to an inflating younger market of buyers, by releasing limited number of products D&G will create exclusivity; this will increase the desire and need for D&G. (Nazir, 2019) .

Dolce and Gabbana:

Dolce and Gabbana will continue to be the luxury high end brand that it currently is. However, the brand will now focus on their traditional consumer demographic of consumers aged 30-50. The catwalks will continue to use traditional models but following the diverse example Dolce and Gabbana has set previously.

Dolce and Gabbana will advertise in more traditional ways to ensure older consumers who may not use social media will have access to; including magazines and celebrities wearing Dolce and Gabbana. The price of this brand will continue to be premium. To re-launch Dolce and Gabbana, the researcher recommends that they open with a line specifically dedicated to the Italian and Mediterranean roots that the brand pride themselves on. By going back to their old roots and designs they will attract the original consumer and will remind them what they love so much about Dolce and Gabbana.

Bibliography

(n.d.). Retrieved from Dolce and Gabbana: http://www.dolcegabbana.com/corporate/en/group/code-of-ethics.html

(n.d.). Retrieved from Dolce and Gabbana: http://www.dolcegabbana.com

(2011). Retrieved from Fashion Lover: https://www.fashionlover.com/6906/dolce-gabbana-s11-collection-17-covers/

(2012). Retrieved from Genius: https://genius.com/Kanye-west-white-dress-lyrics

(2016). Retrieved from GOV: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/513963/BIS-16-193-textile-labelling-regulations-guidance.pdf

(2017). Retrieved from GQ Magazine: https://www.gq-magazine.co.uk/shows/springsummer-2018-menswear/dolce-gabbana

(2018). Retrieved from NBC: https://www.nbcnews.com/news/asian-america/dolce-gabbana-fiasco-shows-importance-risks-china-market-n940706

(2019). Retrieved from Gucci: http://equilibrium.gucci.com/environment/

Abad. (2018). Retrieved from Forbes: https://www.forbes.com/sites/marioabad/2018/03/26/louis-vuitton-appoints-virgil-abloh-as-its-new-mens-artistic-director/

Alexander. (2011). Retrieved from Vogue: https://www.vogue.co.uk/article/dolce-and-gabbana-considers-merging-dandg-line

Apsit-Livens. (2018).Mintel Academic. Retrieved from http://academic.mintel.com/display/907360/?highlight

Arch Daily. (2008). Retrieved from https://www.archdaily.com/2458/dolce-gabbana-headquarters-studio-piuarch

Ati. (2017). Retrieved from https://www.stylecraze.com/articles/most-expensive-clothing-brands/#gref

Baker. (2017). Data Dot. Retrieved from https://www.datadotdna.com/how-counterfeiting-can-destroy-your-brand-business/

BBC . (2018). Retrieved from BBC News: https://www.bbc.co.uk/news/entertainment-arts-46288884

BBC. (2014). BBC. Retrieved from https://www.bbc.co.uk/news/business-29764828

BBC. (2018). Retrieved from https://www.bbc.co.uk/news/entertainment-arts-46288884

Blair. (n.d.). Build Fire. Retrieved from https://buildfire.com/ways-business-benefit-having-mobile-app/

Briggs. (2017). Retrieved from Retail Times: https://www.retailtimes.co.uk/product-pricing-strategies-luxury-brands-revealed-new-report-contactlab-exane-bnp-paribas/

Business of fashion. (n.d.). Retrieved from https://www.businessoffashion.com/community/people/domenico-dolce-stefano-gabbana

Chiorando. (2018). Retrieved from Plant Based News: https://www.plantbasednews.org/post/more-consumers-vegan-fashion-top-designer

Daily Mail. (2013). Retrieved from Mail Online: https://www.dailymail.co.uk/femail/article-2384963/The-REAL-reason-designer-clothes-expensive-How-luxury-brands-raise-prices-increase-appeal.html

DeAcetis. (2018).Forbes. Retrieved from https://www.forbes.com/sites/josephdeacetis/2018/05/14/how-dolce-and-gabbana-defines-a-new-idea-in-millennial-luxury/#2f68450a5e63

Dolce and Gabbana. (n.d.). Retrieved from http://www.dolcegabbana.com/discover/dolce-and-gabbana-inspiration-of-classic-dna-looks-for-men-and-women/

Dolce and Gabbana. (n.d.). Retrieved from http://www.dolcegabbana.com/store-locator/united-kingdom/

Duncan. (2015). Metro. Retrieved from https://metro.co.uk/2015/03/18/dolce-gabbana-in-hot-water-again-after-gang-rape-ad-campaign-resurfaces-just-days-after-ivf-furore-5108624/

Econyl. (2018). Retrieved from https://www.econyl.com/blog/gucci-equilibrium-to-balance-creativity-with-sustainability/

Elle. (2015). Retrieved from https://www.elle.com/uk/fashion/trends/articles/g11120/stars-wearing-dolce-and-gabbana/

Elle. (2015). Retrieved from https://www.elle.com/uk/fashion/trends/articles/g11120/stars-wearing-dolce-and-gabbana/

Ferrier. (2015). The Guardian. Retrieved from https://www.elle.com/uk/fashion/trends/articles/g11120/stars-wearing-dolce-and-gabbana/

Garcia. (2018). Retrieved from Emarketer Retail: https://retail.emarketer.com/article/do-shoppers-care-about-sustainable-fashion/5b0d9ddcebd40003b84919dc

Gimpel. (2017). Marie Claire. Retrieved from http://www.marieclaire.co.za/fashion/going-places-gucci

Hall, & Suen. (2018). Business Of Fashion. Retrieved from https://www.businessoffashion.com/articles/news-analysis/assessing-the-damage-after-the-dolce-gabbana-uproar-racism-china

Helms. (2018). Heroine. Retrieved from https://www.heroine.com/the-editorial/dolce-gabbana-sicilian-influence

Hendriksz. (2016). Fashion United. Retrieved from https://fashionunited.uk/news/fashion/6-effects-a-brexit-may-have-on-the-fashion-industry/2016062020813

Hendriksz. (2018). Fashion United. Retrieved from https://fashionunited.uk/news/fashion/gucci-unveils-gucci-equilibrium-as-it-strengthens-its-sustainability-strategy/2018060530038

Holody, & Flynn. (2017). Taylor and Francis Online. Retrieved from https://www.tandfonline.com/doi/abs/10.1080/10496491.2016.1267679?tokenDomain=eprints&tokenAccess=jnEBaAaE4CYDrRxrJMZe&forwardService=showFullText&doi=10.1080%2F10496491.2016.1267679&doi=10.1080%2F10496491.2016.1267679&journalCode=wjpm20

Ilari. (2009). WWD. Retrieved from https://www.vogue.co.uk/gallery/dolce-gabbana-italian-christmas-market-london-harrods-exclusive

Indvik. (2017). Vogue. Retrieved from https://www.vogue.co.uk/gallery/dolce-gabbana-italian-christmas-market-london-harrods-exclusive

LaManga. (2018). Retrieved from Market watch: https://www.marketwatch.com/story/american-women-are-having-babies-later-and-are-still-conflicted-about-it-2017-05-19

Leslie. (2015). Retrieved from Elle: https://www.elle.com/culture/g27474/2016-trend-predictions/

Liakou. (2017). Retrieved from Dazed: http://www.dazeddigital.com/fashion/article/38234/1/who-has-the-biggest-instagram-following-in-fashion-chanel-louis-vuitton-gucci

Matthew. (2018). Forbes. Retrieved from https://www.forbes.com/sites/theyec/2018/07/30/understanding-influencer-marketing-and-why-it-is-so-effective/#683a27271a94

Michallon. (2018). Daily Mail. Retrieved from https://www.dailymail.co.uk/femail/article-5719551/Isabella-Rosselliniposes-daughter-Elettra-Wiedemann-new-jewelry-campaign.html

Nazir. (2019). Retail Gazette. Retrieved from https://www.retailgazette.co.uk/blog/2019/01/why-luxury-retailers-are-tapping-into-streetwear/

Neimtzow. (2017).BSR. Retrieved from https://www.bsr.org/en/our-insights/blog-view/luxury-sustainability-desirability-two-new-rules-of-the-game

Ogunnaike. (2017). Elle. Retrieved from https://www.elle.com/fashion/news/a43345/dolce-gabbana-fall-show-2017-blogger-models/

Okwodu. (2017). Vogue. Retrieved from https://www.vogue.com/article/dolce-gabbana-spring-2018-models-over-millennials

Parker. (2012). Android Authority . Retrieved from https://www.androidauthority.com/dolce-gabbana-d-g-app-review-97475/

Pithers. (2017). Retrieved from Vogue: https://www.vogue.co.uk/gallery/gucci-announces-it-is-going-fur-free

Querimit. (2018).Humble and Rich. Retrieved from https://boutique.humbleandrich.com/italian-fashion-designer-brands/

Rank A Brand. (2018). Retrieved from https://www.rankabrand.org/sustainable-luxury-brands/Dolce+&+Gabbana

Reinach. (2018). Love To Know. Retrieved from https://fashion-history.lovetoknow.com/fashion-clothing-industry/fashion-designers/dolce-gabbana-brand-history

Robbins. (2017). IBTimes. Retrieved from https://www.ibtimes.co.uk/harrowing-footage-fur-farm-rabbits-used-by-dior-dolce-gabbana-1652378

Ryan. (2017). Launch Metrics. Retrieved from https://www.launchmetrics.com/resources/blog/donatella-versace-millennials-versus

Shannon. (2017). Business of Fashion. Retrieved from https://www.businessoffashion.com/articles/news-analysis/gucci-bans-fur-saying-its-not-modern

Sherman. (2018). Business Of Fashion. Retrieved from https://www.businessoffashion.com/articles/professional/dolce-gabbana-court-controversy-are-their-sales-better-for-it

Statista. (2018). Retrieved from https://www.statista.com/statistics/325587/instagram-global-age-group/

Statista. (2019). Retrieved from https://www.statista.com/statistics/675280/turnover-of-italian-company-dolce-and-gabbana/

Statista. (2019). Retrieved from https://www.statista.com/statistics/267733/global-revenue-share-of-gucci-by-region/

Suen, H. a. (2018). Business Of Fashion. Retrieved from https://www.businessoffashion.com/articles/news-analysis/assessing-the-damage-after-the-dolce-gabbana-uproar-racism-china

Suttle. (n.d.). Retrieved from https://smallbusiness.chron.com/macroenvironmental-factors-affecting-clothing-industry-37254.html

Taylor. (2018). WGSN. Retrieved from https://www-wgsn-com.hallam.idm.oclc.org/news/milan-dolce-gabbana-celeb-fest-shouts-diversity-marni-stays-feminine-relaxed-armani-closes-with-gentle-tailoring/

Turra. (2012). WWD. Retrieved from https://wwd.com/fashion-news/fashion-scoops/joining-the-app-race-6471127/

Valenti. (2018). Vogue. Retrieved from https://www.vogue.com/article/dolce-gabbana-isabella-rossellini-elettra-wiedemann-spring-2019-milan-fashion-week

Wang. (2017). International Excellence. Retrieved from Wang. (2017). International Excellence. Retrieved 27 January, 2019, from https://internationalexcellence.co.uk/content/how-will-brexit-affect-luxury-brands

Webb. (2018). iNews. Retrieved from https://inews.co.uk/inews-lifestyle/travel/pound-euro-dollar-exchange-rate-brexit-sterling-how-affect/

Wiley. (2018). Forbes. Retrieved from https://www.forbes.com/sites/forbesagencycouncil/2018/07/11/beyond-millennials-influencer-marketing-for-older-generations/#51118bdc263a

Winston. (2016). Harvard Business Review. Retrieved from https://hbr.org/2016/02/luxury-brands-can-no-longer-ignore-sustainability

Woolf. (2017). CQ. Retrieved from https://www.gq.com/story/supreme-louis-vuitton-collaboration-2017

Yiassoumi. (2017). Retrieved from Launch Metrics : https://www.launchmetrics.com/resources/blog/dolce-gabbana-loves-millenials

Yotka. (2016). Vogue. Retrieved from https://www.vogue.com/article/dolce-and-gabbana-sicilian-references

Articles:

Kim, A.J., &Ko, E. (2012). Do social media marketing activities enhance customer equity?

An empirical study of luxury fashion brand. Journal of Business Research, 65(10), 1480-1486.

Retrieved February 22, 2019.

McNeil, L., & Moore, R. (2015). Sustainable fashion consumption and the fast fashion conundrum: Fashionable consumers and attitudes to sustainability in clothing choice. International Journal of Consumer Studies,39(3). Retrieved January 25, 2019.

Mears, A. (2010). Size Zero high-end ethnic: Cultural production and the reproduction of culture in fashion modeling. Poetics,38(1), 21-46. Retrieved January 20, 2019.

Books:

Leitch, L., & Evans, B. (2017) Vogue On Dolce And Gabbana.London: Quadrille Publishing.

Quotes:

Dolce, D. (2017) Vogue on Dolce And Gabbana. London: Quadrille Publishing.

Stefano Gabbana. (2017). Retrieved from https://www.hellomagazine.com/fashion/news/2017011656715/dolce-gabbana-influencer-show-pre-fall-2017/

Comments

Post a Comment